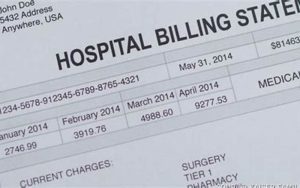

Dealing with medical bills after receiving treatment can be a daunting and stressful experience. Even after having health insurance, many individuals still find themselves with substantial medical bills to pay. However, you may wonder if it is possible to negotiate your medical bills after insurance. The answer is yes, and this article will guide you through the process of negotiating medical bills after insurance.

What is Medical Billing?

Medical billing is the process of submitting and following up on claims with health insurance companies to receive payment for services rendered by a healthcare provider. Medical billing also involves the generation of invoices and statements, and the resolution of any billing discrepancies or denied claims.

Understanding Medical Billing Terminology

Before diving into the process of negotiating medical bills after insurance, it is essential to understand some commonly used medical billing terminology. Here are some of them:

| Term | Definition |

|---|---|

| Copay | A fixed amount you pay for medical services at the time of service. |

| Deductible | The amount you need to pay out of pocket before the insurance pays for your medical bills. |

| Coinsurance | The percentage of healthcare costs you pay after meeting your deductible. |

| Out-of-Pocket Maximum | The total amount you need to pay for medical services each year before insurance covers all costs. |

Can You Negotiate Medical Bills After Insurance?

Yes, you can always negotiate medical bills after insurance. Even after your insurance has paid its portion, you can still request a discount or negotiate a payment plan with your healthcare provider.

Why Should You Negotiate Medical Bills After Insurance?

There are several reasons why you should negotiate your medical bills after insurance:

- To save money: Negotiating medical bills after insurance may result in a lower bill, which can save you money.

- To avoid debt: High medical bills can lead to debt, and negotiating can help you avoid this financial burden.

- To improve your credit score: Medical bills sent to collections can negatively impact your credit score, and negotiating can help you avoid this.

Steps to Negotiate Medical Bills After Insurance

Here are the steps you should follow to negotiate your medical bills after insurance:

- Review your medical bill: Before negotiating, review your medical bill to ensure that all charges are accurate and valid. If you find any errors or discrepancies, contact your healthcare provider to have them corrected.

- Understand your insurance coverage: It is essential to understand your insurance coverage, including your deductible, out-of-pocket maximum, and coinsurance, before negotiating.

- Prepare to negotiate: Gather any supporting documents or evidence to support your request for a discount or payment plan. This may include medical records, invoices, and financial statements.

- Contact your healthcare provider: Reach out to your healthcare provider to discuss your medical bill and negotiate a discount or payment plan. Be polite but firm in your request, and provide any supporting documents or evidence.

- Get everything in writing: Once you have negotiated a lower bill or payment plan, make sure to get everything in writing to avoid any future misunderstandings or disputes.

- Follow up: If you have negotiated a payment plan, make sure to follow up and make payments on time to avoid any negative consequences.

Common Questions About Negotiating Medical Bills After Insurance

1. What if I can’t afford to pay my medical bills?

If you are unable to pay your medical bills, consider contacting your healthcare provider to request financial assistance or explore other options, such as charity care programs or medical bill advocacy services.

2. What if my insurance denies my claim?

If your insurance denies your claim, you can appeal the decision or negotiate a lower bill with your healthcare provider. You can also explore alternative payment options, such as healthcare credit cards or personal loans.

3. Can I negotiate my medical bills before receiving treatment?

It is possible to negotiate your medical bills before receiving treatment, but this may require some research and legwork. You can contact healthcare providers ahead of time to discuss pricing and payment options or use online resources to compare costs and quality ratings.

4. How much can I expect to save by negotiating my medical bills?

The amount you can save by negotiating your medical bills varies depending on several factors, such as the type of service or treatment you received, your insurance coverage, and your healthcare provider’s policies. However, even a small discount or payment plan can make a significant difference in your financial situation.

5. Will negotiating my medical bills affect my credit score?

No, negotiating your medical bills should not affect your credit score. However, failure to pay your medical bills or sending them to collections can negatively impact your credit score.

6. Can I negotiate medical bills for services not covered by insurance?

Yes, you can negotiate medical bills for services not covered by insurance. In this case, you may be able to negotiate a lower fee or payment plan directly with your healthcare provider.

7. Why do healthcare providers offer discounts or payment plans?

Healthcare providers may offer discounts or payment plans to incentivize patients to pay their bills on time or to avoid sending bills to collections. Additionally, offering discounts or payment plans can improve patient satisfaction and loyalty.

Conclusion

Dealing with medical bills after insurance can be overwhelming, but you should know that you can negotiate your bills. Negotiating can save you money, help you avoid debt, and improve your credit score. Remember to prepare, be polite but firm, and get everything in writing. If you have trouble negotiating, consider reaching out to medical bill advocacy services for help.

So, can you negotiate medical bills after insurance? The answer is yes, and we hope this article has provided you with all the necessary information and steps to negotiate your medical bills effectively.

Sources:

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3584675/

- https://www.npr.org/sections/health-shots/2019/01/02/677837956/how-to-negotiate-a-medical-bill-even-a-lower-one

- https://www.consumerreports.org/hospital-financial-assistance/negotiate-medical-bills/

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024