Introduction:

Car insurance is a necessity for drivers in the state of New York. It not only protects you from potential financial loss in case of an accident but also keeps you in compliance with the law. However, finding the right car insurance NY rate can be overwhelming, as there are many factors to consider, such as coverage options, deductibles, and premiums. In this article, we will guide you through everything you need to know about car insurance NY rate, so you can make an informed decision and choose the best coverage for you and your vehicle.

What is Car Insurance NY Rate?

Car insurance NY rate is the amount you pay to your insurance provider for the coverage provided by the policy. Car insurance rates are determined by a variety of factors, including the type of coverage you choose, your driving history, the make and model of your vehicle, your credit score, and your location. The cost of car insurance in New York varies depending on the coverage you select and other factors that impact your risk profile.

Factors That Affect Car Insurance NY Rate:

There are several factors that can influence your car insurance NY rate, such as:

| Factors That Affect Car Insurance NY Rate |

|---|

| Type of Coverage |

| Driving History |

| Make and Model of Your Vehicle |

| Your Credit Score |

| Location |

Types of Coverage:

The type of coverage you choose is one of the most significant factors that can impact your car insurance NY rate. There are several types of coverage, including:

- Liability Coverage: This coverage protects you in case you are found at fault for an accident that results in injury to others or damage to property. The liability coverage limit in New York is $25,000 for injury or death of one person, $50,000 for injury or death of more than one person, and $10,000 for property damage.

- Collision Coverage: This coverage pays for the damage to your vehicle in case of a collision with another vehicle or an object, such as a tree or a fence.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by non-collision events, such as theft, vandalism, fire, or natural disasters.

- Personal Injury Protection (PIP) Coverage: This coverage pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or whose insurance does not cover all the damages.

Driving History:

Another significant factor that can impact your car insurance NY rate is your driving history. Insurance providers look at your driving record to evaluate the likelihood of you filing a claim in the future. If you have a history of accidents or traffic violations, your car insurance NY rate is likely to be higher than someone with a clean driving record. However, some insurance providers offer discounts to drivers who have completed a defensive driving course or have a history of safe driving.

Vehicle Make and Model:

The make and model of your vehicle also impact your car insurance NY rate. Insurance providers use data, such as the vehicle’s safety record and repair costs, to determine the likelihood of you filing a claim. Generally, more expensive or newer vehicles cost more to insure due to the higher cost of repairs or replacement. On the other hand, vehicles with a good safety rating or equipped with safety features, such as airbags and anti-lock brakes, may qualify for discounts.

Your Credit Score:

Your credit score is another factor that can impact your car insurance NY rate. Insurance providers use credit-based insurance scores, which are based on credit history and other financial data, to determine the likelihood of you filing a claim. Studies have shown that people with lower credit scores are more likely to file insurance claims, resulting in higher car insurance NY rates.

Location:

Your location also plays a role in determining your car insurance NY rate. Urban areas and areas with a high crime rate tend to have higher car insurance NY rates due to the increased likelihood of accidents or theft. On the other hand, rural areas with less traffic and lower crime rates may have lower car insurance rates.

FAQs About Car Insurance NY Rate:

1. How can I find the best car insurance NY rate?

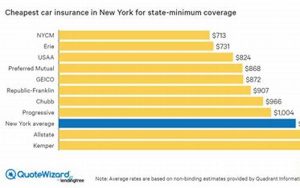

To find the best car insurance NY rate, you should shop around and compare quotes from different insurance providers. You can also consider factors, such as coverage options, deductibles, and premiums, to evaluate the value of each policy. Working with an insurance agent can also help you find the best car insurance NY rate that meets your specific needs and budget.

2. How can I lower my car insurance NY rate?

There are several ways to lower your car insurance NY rate, such as:

- Choose a higher deductible

- Opt for a lower level of coverage

- Drive a safe vehicle with good safety features

- Complete a defensive driving course

- Bundle your car insurance with other types of insurance, such as homeowners or renters insurance

3. What is the minimum car insurance requirement in New York?

In New York, drivers are required to have liability coverage of at least $25,000 for injury or death of one person, $50,000 for injury or death of more than one person, and $10,000 for property damage. Personal Injury Protection (PIP) coverage is also mandatory in New York.

4. What factors can increase my car insurance NY rate?

Several factors can increase your car insurance NY rate, such as:

- Having a poor driving record

- Driving a high-end or luxury vehicle

- Living in an urban area or high crime area

- Having a lower credit score

5. Can I get car insurance with a suspended license?

It is highly unlikely that you will be able to get car insurance with a suspended license. In most cases, insurance providers require a valid driver’s license to issue a policy.

6. How often should I review my car insurance NY rate?

You should review your car insurance NY rate annually or whenever you experience a significant life change, such as buying a new car or moving to a new location. Regularly reviewing your car insurance NY rate can help you ensure that you are getting the best value for your coverage and adjust your policy based on your changing needs.

7. Can I add someone else’s car to my car insurance policy?

Yes, you can add someone else’s car to your car insurance policy, but you will need to have their permission and provide the relevant information, such as the make and model of the vehicle and the driver’s information. The cost of adding another vehicle to your policy may depend on factors like the age and driving history of the additional driver and the make and model of the car.

Conclusion:

Finding the right car insurance NY rate can be challenging, but understanding the factors that impact it can help you make an informed decision. By considering factors such as coverage options, deductibles, and premiums, you can find the policy that meets your needs and budget. Remember to regularly review your policy and shop around for the best car insurance NY rate to ensure that you have the best coverage possible.

Source: https://www.ny.gov/insurance/car-insurance

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024