Insurance Rates NC: An Overview

Are you planning to purchase a car or buy a new home in North Carolina? If yes, then you need to be aware of the insurance rates in NC. Insurance rates are the premiums that an individual needs to pay to avail of different types of insurance coverage in NC. Insurance rates can vary significantly based on several factors such as age, credit score, driving history, and geographic location.

In this comprehensive guide, we will discuss everything you need to know about insurance rates in NC. Read on to find out more.

Factors Affecting Insurance Rates in NC

Age and Gender

Age and gender are two of the most common factors affecting insurance rates in NC. Young drivers generally have higher insurance rates than older adults as they are more likely to get into accidents. Gender is also a factor as women are generally considered safer drivers than men, leading to lower insurance rates in many cases.

Credit Score

Your credit score is a reflection of your creditworthiness and your ability to pay off debts. Insurance companies consider your credit score while calculating insurance rates. A higher credit score usually results in lower insurance rates.

Driving History

Your driving history is also a significant factor affecting insurance rates in NC. Individuals with a history of traffic violations, accidents, or DUIs are considered to be higher-risk drivers and may have to pay higher insurance rates than those with clean driving records.

Geographic Location

Your location can also influence insurance rates in NC. Individuals living in urban areas with a high crime rate or a high likelihood of natural disasters may have to pay higher insurance rates than individuals living in rural areas with lower crime rates.

Vehicle Type

The type of vehicle you own is another factor affecting insurance rates in NC. Expensive or luxury vehicles generally have higher insurance rates than standard vehicles due to their higher replacement costs. Additionally, high-performance vehicles have higher insurance rates as they are more likely to be involved in accidents.

Insurance Coverage Amount

The amount of insurance coverage you require will also affect your insurance rates. Individuals with higher coverage amounts will generally have to pay higher premiums than those with lower coverage amounts.

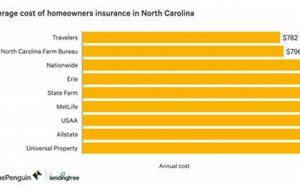

Insurance Company

The insurance company you choose to purchase insurance from can also affect your insurance rates in NC. Each insurance company has its own underwriting guidelines, which means that the same driver can receive different insurance rates from different companies.

How to Get Lower Insurance Rates in NC

Improve Your Credit Score

One of the best ways to get lower insurance rates in NC is to improve your credit score. You can do this by paying your bills on time, keeping your credit utilization low, and monitoring your credit report regularly.

Take Advantage of Discounts

Most insurance companies offer discounts to customers who meet certain criteria such as safe driving records, multiple policies, and vehicle safety features. Be sure to ask your insurance company about available discounts to see if you qualify.

Choose the Right Vehicle

Choosing the right vehicle can also help you get lower insurance rates in NC. Vehicles with safety features such as airbags, anti-lock brakes, and backup cameras generally have lower insurance rates than vehicles without these features. Additionally, vehicles with high safety ratings are also likely to have lower insurance rates.

Shop Around for Insurance

Shopping around for insurance is another way to get lower insurance rates in NC. Be sure to compare policies and rates from multiple insurance companies before making a decision.

Pay Higher Deductibles

You can also get lower insurance rates in NC by paying higher deductibles. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance rates, but it also means you’ll have to pay more out of pocket in the event of an accident or other covered event.

Drive Safely

Finally, driving safely is the best way to keep your insurance rates low in NC. Avoid speeding, distractions while driving, and other high-risk driving behaviors that could lead to accidents or traffic violations.

FAQs About Insurance Rates NC

What are the minimum insurance requirements in NC?

North Carolina requires all drivers to carry liability insurance with minimum limits of $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage per accident.

What happens if I don’t have insurance in NC?

If you are caught driving without insurance in NC, you could face fines, license suspension, and even jail time. Additionally, if you are involved in an accident and do not have insurance, you may be responsible for paying for damages out of pocket.

How can I lower my insurance rates in NC?

You can lower your insurance rates in NC by improving your credit score, taking advantage of discounts, choosing the right vehicle, shopping around for insurance, paying higher deductibles, and driving safely.

What factors affect insurance rates in NC?

Several factors affect insurance rates in NC, including age, gender, credit score, driving history, geographic location, vehicle type, insurance coverage amount, and insurance company.

What discounts are available for auto insurance in NC?

Some of the most common discounts available for auto insurance in NC include safe driver discounts, multi-car discounts, good student discounts, and vehicle safety feature discounts.

Can I get insurance if I have a bad driving record?

Yes, it is possible to get insurance in NC even if you have a bad driving record. However, you may have to pay higher insurance rates than someone with a clean driving record.

How often should I shop around for insurance in NC?

It’s a good idea to shop around for insurance in NC at least once a year to make sure you are getting the best rates and coverage for your needs.

Conclusion

Insurance rates in NC can be influenced by several factors, including age, gender, credit score, driving history, geographic location, vehicle type, insurance coverage amount, and insurance company. However, there are several ways to get lower insurance rates in NC, including improving your credit score, taking advantage of discounts, choosing the right vehicle, shopping around for insurance, paying higher deductibles, and driving safely.

Be sure to compare policies and rates from multiple insurance companies to get the best coverage and rates for your needs. Keep these tips in mind and stay safe on the roads in North Carolina.

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024