Are you looking for information on SR22 insurance in Miami, FL? Look no further! In this article, we will cover everything you need to know about SR22 insurance, including what it is, why you might need it, and how to get it in Miami, FL.

What is SR22 Insurance?

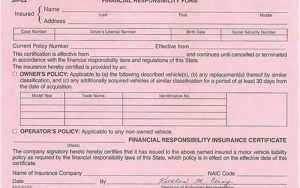

SR22 insurance is a type of auto insurance that is required by law in some states for drivers who have been convicted of certain offenses, such as driving under the influence (DUI) or driving without insurance. It is not actually insurance itself, but rather a form that your insurance company files with the state to prove that you are carrying the required amount of liability coverage.

In Miami, FL, SR22 insurance is required for drivers who have been convicted of certain offenses, including DUI, driving without insurance, and driving with a suspended license.

Why Might You Need SR22 Insurance?

There are several reasons why you might need SR22 insurance:

- You have been convicted of a DUI

- You have been caught driving without insurance

- You have been driving with a suspended license

- You have been in a serious accident and do not have enough insurance to cover the damages

If you are required to have SR22 insurance, it is important to remember that it is not optional. Failing to obtain and maintain the required SR22 insurance can result in serious consequences, such as having your license suspended or even being sent to jail.

How Do You Get SR22 Insurance in Miami, FL?

Getting SR22 insurance in Miami, FL is a fairly straightforward process. Here are the steps you will need to take:

- Contact your insurance company

- Inform them that you need to file an SR22 form

- Provide them with any necessary information, such as your driver’s license number and the reason you need SR22 insurance

- Pay any required fees

- The insurance company will file the SR22 form with the state on your behalf

It is important to note that not all insurance companies offer SR22 insurance. If your current insurance company does not offer it, you will need to shop around and find a company that does.

What Does SR22 Insurance Cover?

SR22 insurance is not actually insurance itself, but rather a form that your insurance company files with the state to prove that you are carrying the required amount of liability coverage. This means that it will cover the same things that your regular auto insurance covers, including:

- Bodily injury liability

- Property damage liability

However, it is important to note that you may be required to carry more coverage than you would with a regular auto insurance policy.

How Much Does SR22 Insurance Cost in Miami, FL?

The cost of SR22 insurance in Miami, FL can vary depending on several factors, including:

- Your driving record

- The reason you need SR22 insurance

- The amount of coverage you need

- The insurance company you choose

Generally speaking, SR22 insurance is more expensive than regular auto insurance. However, the cost can vary widely, so it is important to shop around and compare prices from several different insurance companies.

Frequently Asked Questions About SR22 Insurance in Miami, FL

1. What is the difference between SR22 insurance and regular auto insurance?

SR22 insurance is not actually insurance itself, but rather a form that your insurance company files with the state to prove that you are carrying the required amount of liability coverage. It covers the same things that your regular auto insurance covers, but you may be required to carry more coverage than you would with a regular auto insurance policy.

2. How long do I need SR22 insurance?

The length of time that you will be required to carry SR22 insurance in Miami, FL can vary depending on the reason you need it. Generally speaking, you will be required to carry SR22 insurance for a period of 1-3 years.

3. How do I know if I need SR22 insurance?

If you have been convicted of certain offenses, such as DUI or driving without insurance, you may be required to carry SR22 insurance. You can check with the Florida Department of Highway Safety and Motor Vehicles to find out if you need SR22 insurance.

4. Can I get SR22 insurance without a car?

Yes, you can still get SR22 insurance even if you do not own a car. You can purchase a non-owner insurance policy, which will provide you with liability coverage when you are driving someone else’s car.

5. What happens if I let my SR22 insurance lapse?

If you fail to maintain your SR22 insurance in Miami, FL, your license may be suspended or revoked. You will need to obtain new SR22 insurance and pay any associated fees in order to have your license reinstated.

6. How can I find the best SR22 insurance rates in Miami, FL?

The best way to find the best SR22 insurance rates in Miami, FL is to shop around and compare prices from several different insurance companies. You can also ask for recommendations from friends and family members who have had to obtain SR22 insurance in the past.

7. Can I switch insurance companies while I have SR22 insurance?

Yes, you can switch insurance companies while you have SR22 insurance. However, it is important to make sure that your new insurance company offers SR22 insurance before you switch.

Conclusion

In conclusion, SR22 insurance is a type of auto insurance that is required by law in some states for drivers who have been convicted of certain offenses, such as DUI or driving without insurance. In Miami, FL, SR22 insurance is required for drivers who have been convicted of certain offenses, including DUI, driving without insurance, and driving with a suspended license. If you are required to have SR22 insurance, it is important to remember that it is not optional. Failing to obtain and maintain the required SR22 insurance can result in serious consequences, such as having your license suspended or even being sent to jail.

To obtain SR22 insurance in Miami, FL, you will need to contact your insurance company and inform them that you need to file an SR22 form. The insurance company will file the form with the state on your behalf. The cost of SR22 insurance can vary, so it is important to shop around and compare prices from several different insurance companies.

Remember, if you have any questions or concerns about SR22 insurance in Miami, FL, you can always contact the Florida Department of Highway Safety and Motor Vehicles for more information.

|

| Image source: https://tse1.mm.bing.net/th?q=subtitle |

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024