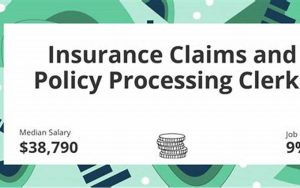

Insurance Claims and Policy Processing Clerks

Insurance claims and policy processing clerks are responsible for ensuring that insurance claims are processed efficiently and accurately. Their role involves reviewing claims paperwork, determining policy coverage and limits, and processing payments to policyholders.

Insurance claims and policy processing clerks work for insurance companies, government agencies, and third-party administrators. They are typically required to have a high school diploma or equivalent, although some employers may prefer applicants with an associate degree in business or a related field. In addition, they must have excellent communication skills, attention to detail, and the ability to work independently and as part of a team.

Job Responsibilities of Insurance Claims and Policy Processing Clerks

The primary responsibility of insurance claims and policy processing clerks is to process insurance claims. This requires them to perform a variety of tasks, such as:

Reviewing Claims Paperwork

Insurance claims and policy processing clerks are responsible for reviewing claims paperwork to ensure that it is complete and accurate. They must review documents such as medical bills, police reports, and accident reports to ensure that they are consistent with the reported incident and comply with policy coverage.

Determining Policy Coverage and Limits

Insurance claims and policy processing clerks must determine policy coverage and limits by reviewing the policy documents and comparing them to the claims paperwork. They must accurately determine the extent of coverage and limits based on policy parameters and state laws.

Processing Payments to Policyholders

Insurance claims and policy processing clerks process payments to policyholders for approved claims. They ensure that payments are made accurately and in a timely manner according to policy terms and conditions.

Communicating with Policyholders and External Parties

Insurance claims and policy processing clerks must communicate with policyholders to obtain additional information about claims and explain coverage and limits. They must also communicate with external parties such as doctors, lawyers, and law enforcement officials to gather information and resolve claims disputes.

Maintaining Accurate Records

Insurance claims and policy processing clerks must maintain accurate records of claims and policyholder information. They must ensure that all records are properly organized and securely stored.

Investigating Claims

Insurance claims and policy processing clerks may be required to investigate claims to verify information or resolve disputes. They may need to interview witnesses or gather additional information from policyholders or other parties.

Paying Attention to Detail

Insurance claims and policy processing clerks must have excellent attention to detail to ensure that all claims and policyholder information is accurate. Any errors can result in delays in processing claims or payments.

FAQs about Insurance Claims and Policy Processing Clerks

1. What qualifications do I need to become an insurance claims and policy processing clerk?

You must have a high school diploma or equivalent. Some employers may prefer applicants with an associate degree in business or a related field.

2. Is experience required to become an insurance claims and policy processing clerk?

Some employers may require or prefer candidates with previous experience in insurance claims or policy processing.

3. What skills are needed to become an insurance claims and policy processing clerk?

You must have excellent communication skills, attention to detail, and the ability to work independently and as part of a team. You must also be able to multitask and handle a heavy workload.

4. What is the average salary for insurance claims and policy processing clerks?

The average salary for insurance claims and policy processing clerks is approximately $41,000 per year.

5. What are the typical work hours for insurance claims and policy processing clerks?

Insurance claims and policy processing clerks typically work full-time hours during regular business hours. Some may also work evenings or weekends to accommodate customer needs.

6. Is there room for advancement in the insurance claims and policy processing field?

Yes, there are opportunities for advancement in the insurance claims and policy processing field. You may be able to advance to a supervisory role or into management with experience and further education.

7. What are some of the challenges faced by insurance claims and policy processing clerks?

Some of the challenges faced by insurance claims and policy processing clerks include managing a heavy workload, dealing with difficult customers, and resolving claims disputes.

Conclusion

Insurance claims and policy processing clerks play a vital role in ensuring that insurance claims are processed efficiently and accurately. They must have excellent communication skills, attention to detail, and the ability to work independently and as part of a team. The typical salary for insurance claims and policy processing clerks is approximately $41,000 per year, and there are opportunities for advancement in the field with experience and further education.

If you are interested in pursuing a career in insurance claims and policy processing, there are a variety of job opportunities available. However, it is important to ensure that you have the necessary qualifications and skills before applying for a position.

Thank you for reading this article on insurance claims and policy processing clerks! We hope that it has provided you with valuable information about this important role in the insurance industry.

Job Responsibilities |

FAQs |

|---|---|

| Reviewing Claims Paperwork | 1. What qualifications do I need to become an insurance claims and policy processing clerk? |

| Determining Policy Coverage and Limits | 2. Is experience required to become an insurance claims and policy processing clerk? |

| Processing Payments to Policyholders | 3. What skills are needed to become an insurance claims and policy processing clerk? |

| Communicating with Policyholders and External Parties | 4. What is the average salary for insurance claims and policy processing clerks? |

| Maintaining Accurate Records | 5. What are the typical work hours for insurance claims and policy processing clerks? |

| Investigating Claims | 6. Is there room for advancement in the insurance claims and policy processing field? |

| Paying Attention to Detail | 7. What are some of the challenges faced by insurance claims and policy processing clerks? |

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024