Introduction

Car accidents can happen to anyone, and they can result in serious injuries and damages. That’s why it’s essential to have the proper car insurance coverage to protect yourself and your assets. In Virginia, automobile insurance laws regulate the minimum level of coverage required for drivers to legally operate their vehicles on the state’s roads.

In this article, we’ll discuss Virginia automobile insurance laws in detail, including the minimum coverage requirements, penalties for non-compliance, and frequently asked questions about car insurance in Virginia.

Virginia Automobile Insurance Laws

Virginia requires all drivers to have a minimum amount of liability insurance coverage, which includes bodily injury and property damage liability. Bodily injury liability coverage pays for injuries to other people in an accident that you caused, while property damage liability coverage pays for damages to other people’s property.

Under Virginia law, the minimum liability coverage amounts are:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident |

| Property Damage Liability | $20,000 per accident |

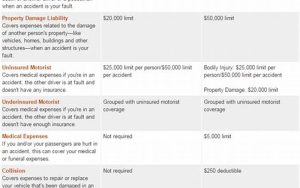

If you want more protection than the minimum required liability coverage, you can purchase additional coverage options, such as collision and comprehensive coverage. Collision coverage pays for damages to your vehicle in an accident, regardless of who is at fault, while comprehensive coverage pays for damages to your vehicle caused by non-collision events, such as theft or natural disasters.

It’s essential to note that Virginia is an at-fault car insurance state, meaning that the driver who caused the accident is responsible for paying for damages and injuries to the other party. If you’re found to be at fault for an accident, your liability insurance coverage will pay for damages to the other party up to your policy limits.

Penalties for Non-Compliance

If you’re caught driving without the minimum required insurance coverage in Virginia, you could face severe penalties, including fines, license suspension, and even jail time. The penalties for non-compliance with Virginia automobile insurance laws are:

- A fine of up to $500 for the first offense

- A fine of up to $1,000 for the second and subsequent offenses

- License suspension until you provide proof of insurance coverage

- Requirement to file an SR-22 form with the Virginia DMV as proof of insurance coverage

- Cancellation of your vehicle registration

- Requirement to pay a reinstatement fee to get your license and registration back

- Possible jail time for repeat offenders or if you cause an accident while driving without insurance

Getting Car Insurance in Virginia

To get car insurance in Virginia, you must contact a licensed insurance provider and purchase the required coverage. You can purchase insurance online, over the phone, or in person at an insurance company office. When you buy car insurance, make sure you understand the policy’s terms and conditions, including the coverage amounts, deductibles, and exclusions.

Before buying car insurance, it’s a good idea to shop around and compare quotes from multiple insurance providers to find the best coverage and rates. You can also check the financial strength ratings and customer satisfaction ratings of insurance companies before making a decision.

FAQs About Virginia Automobile Insurance Laws

1. Is Car Insurance Required in Virginia?

Yes, Virginia requires all drivers to have a minimum amount of liability insurance coverage, which includes bodily injury and property damage liability. You must have proof of insurance coverage with you whenever you’re driving.

2. What Happens if I Drive Without Insurance in Virginia?

If you’re caught driving without the minimum required insurance coverage in Virginia, you could face severe penalties, including fines, license suspension, and even jail time. See the “Penalties for Non-Compliance” section above for more information.

3. What is the Minimum Car Insurance Coverage Required in Virginia?

Virginia requires all drivers to have at least $25,000 per person and $50,000 per accident in bodily injury liability coverage, as well as $20,000 per accident in property damage liability coverage.

4. What Additional Car Insurance Coverage Options are Available in Virginia?

In addition to the minimum required liability coverage, you can purchase additional coverage options, such as collision and comprehensive coverage, to provide more protection for your vehicle. Collision coverage pays for damages to your vehicle in an accident, regardless of who is at fault, while comprehensive coverage pays for damages to your vehicle caused by non-collision events, such as theft or natural disasters.

5. What Factors Affect Car Insurance Rates in Virginia?

Car insurance rates in Virginia are affected by several factors, including your age, driving record, location, vehicle make and model, and coverage amounts. Insurance providers also consider your credit score when calculating rates. Generally, drivers with clean driving records and high credit scores pay lower insurance rates.

6. Can I Get Car Insurance if I Have a Poor Driving Record?

Yes, you can still get car insurance in Virginia if you have a poor driving record, but you may have to pay higher insurance rates. Some insurance companies specialize in providing coverage to high-risk drivers and may offer lower rates than other providers. It’s essential to shop around and compare quotes from multiple providers to find the best coverage and rates.

7. What Should I Do if I’m Involved in a Car Accident in Virginia?

If you’re involved in a car accident in Virginia, you should stop at the scene and exchange information with the other driver, including names, contact information, and insurance information. You should also contact the police and report the accident, especially if there are injuries or significant damages. Make sure to document the accident scene and damages with photos or videos, and contact your insurance provider to report the claim and get assistance with the claims process.

Conclusion

Virginia automobile insurance laws require all drivers to have a minimum amount of liability insurance coverage to legally operate their vehicles on the state’s roads. Driving without insurance can result in severe penalties, including fines, license suspension, and even jail time. To protect yourself and your assets, it’s essential to purchase the proper car insurance coverage and understand your policy’s terms and conditions. By following Virginia automobile insurance laws and driving safely, you can ensure that you and other drivers on the road stay protected in case of an accident.

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024

Aplikasi Trending 2024 Informasi dan Review Aplikasi Terbaru Trending 2024